KEEP UP WITH OUR DAILY AND WEEKLY NEWSLETTERS

PRODUCT LIBRARY

designboom is presenting the sound machines of love hultén at sónar festival in barcelona this june!

connections: 74

with behemoth installations, scandinavia's largest exhibition of anish kapoor's works opens at ARKEN museum.

connections: +390

a powerful symbol of the house’s cultural heritage, the jockey silk with colorful geometric motifs is an inspiration for leather goods and textiles.

connections: +670

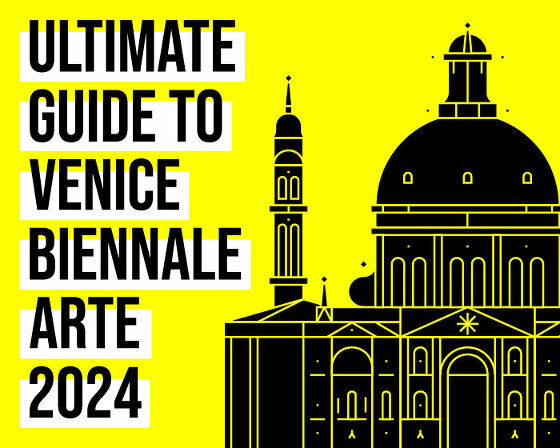

we're getting ready for the pre-opening launching today until friday, with public access scheduled for the 20th.

connections: 13