DEBT COMPENSATION SYSTEM by Gavrila from romania

designer's own words:

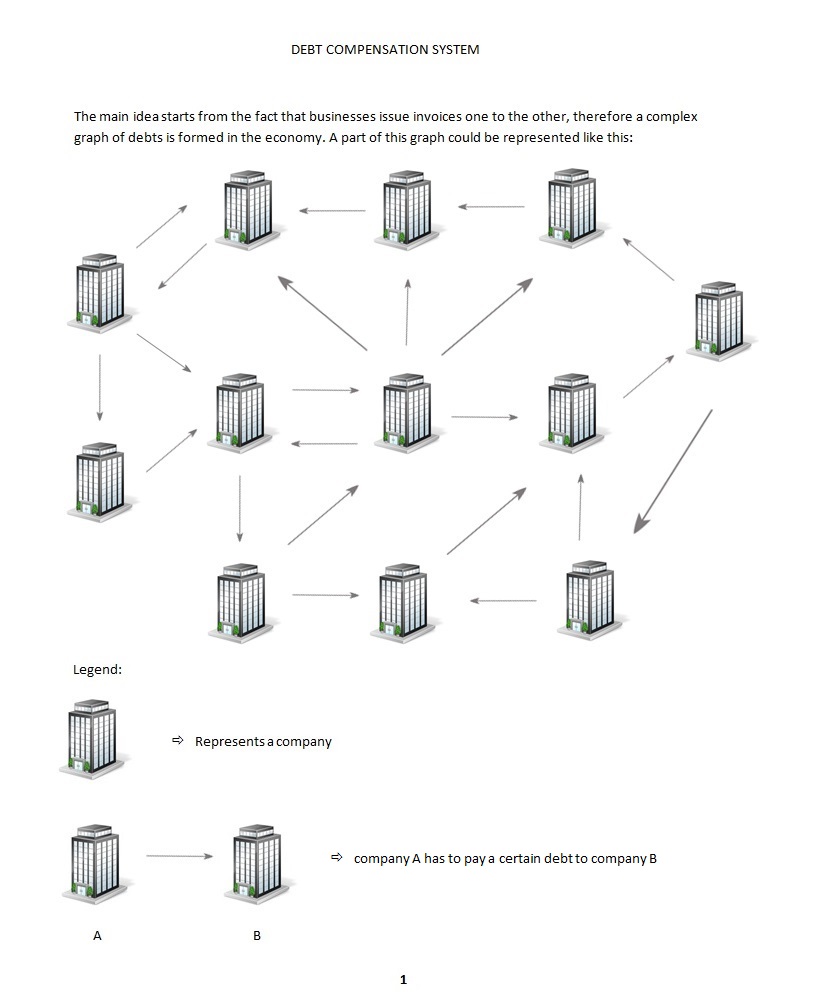

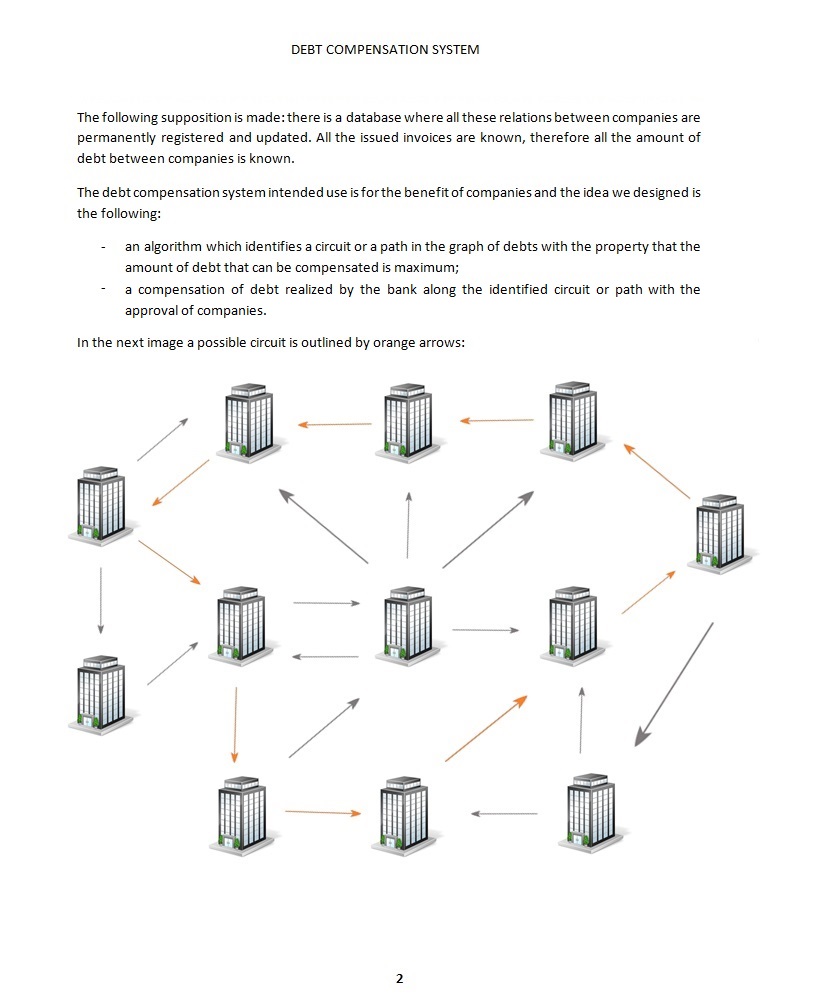

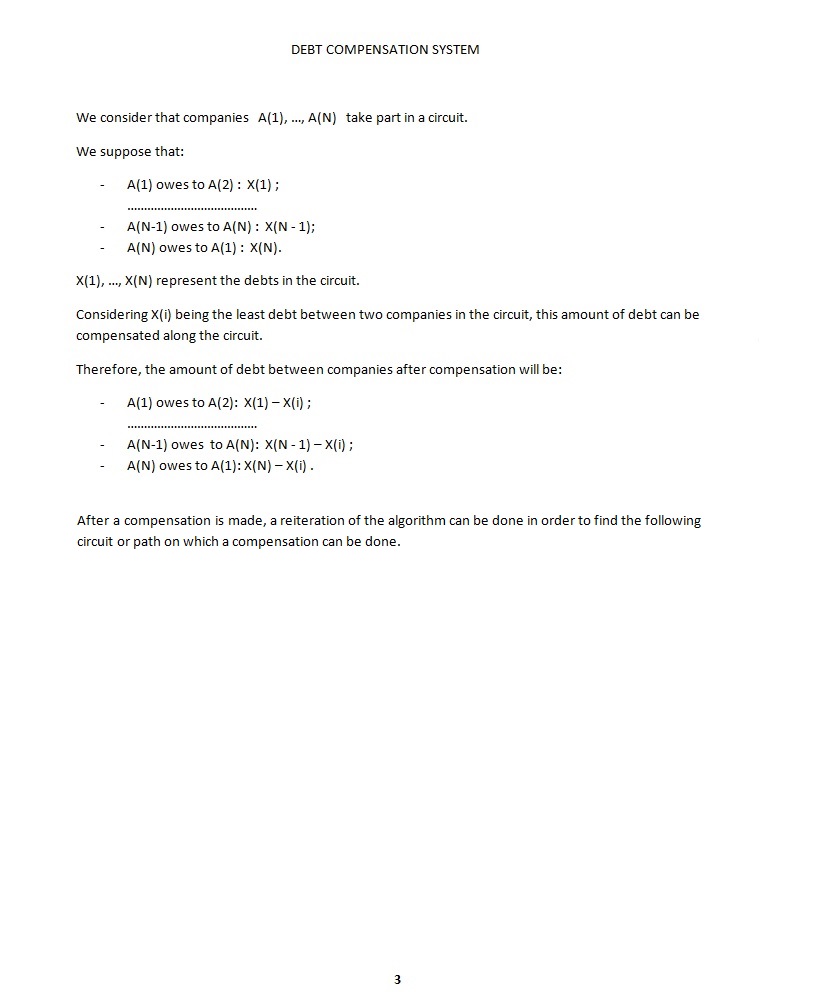

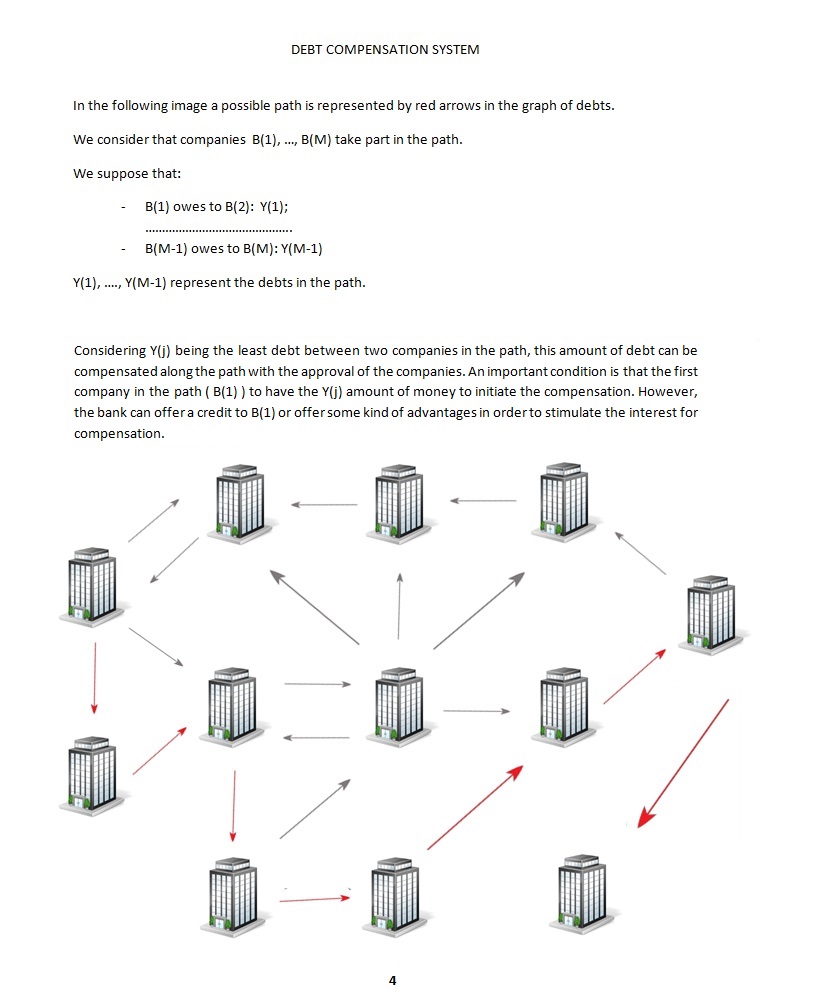

The idea we designed for “Future Banking” competition implies some of the most recent findings in Big Data, is intended for the benefit of the companies and refers to a debt compensation system which can be implemented through a bank. Businesses issue invoices one to the other, therefore a complex graph of debts is formed in the economy. In our idea we supposed that the debt relations are permanently registered in a database, the debt graph being always updated. The debt compensation system is represented by an algorithm which finds circuits and paths in this graph, these having the property that the amount of debt which can be compensated along them is maximum. A circuit is represented by a set of companies between which there is a circuit of debts. Among this debts there is a common debt which can be reduced from all the companies. Knowing the structure of these circuits, the bank can ask the companies for the compensation of debt. The idea behind a path in the graph of debts is similar. The system will be useful for the reduction of insolvency risk, better use of funds by the companies, attraction of more clients for the bank.

Image 1 – The introduction

Image 2 – Debt circuits in economy

Image 3 – Compensation of debt using identified circuits

Image 4 – Debt paths in economy

Image 5 – Advantages of the debt compensation system